Are you nakd stock for a thrilling adventure into the world of stock market trends? Strap in, because we’re about to dive deep into the captivating story of Nakd stock and its performance over time. From soaring highs to unexpected lows, this enigmatic stock has left investors on the edge of their seats. Join us as we unravel the mysteries behind Nakd stock’s rollercoaster journey, exploring the factors that influence its performance and uncovering the impact of social media and Reddit on its wild ride. If you’re looking to navigate these volatile waters or simply satisfy your curiosity, keep reading – it’s time to crack the code!

Understanding the Performance Trends of Nakd Stock

Understanding the Performance Trends of Nakd Stock

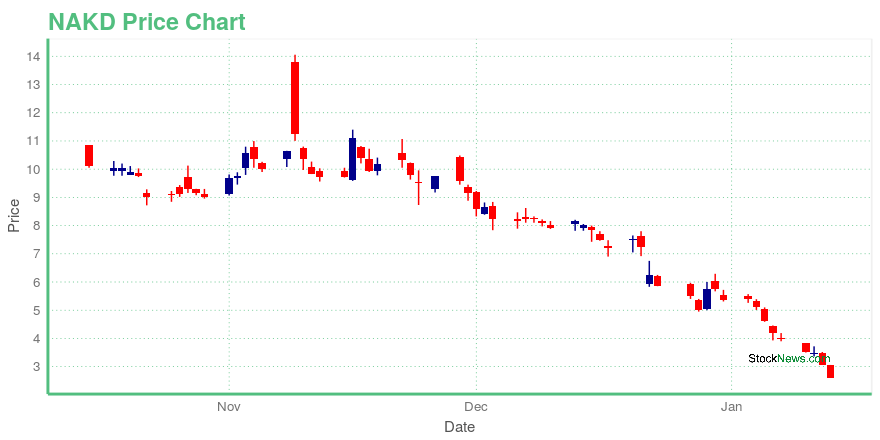

When it comes to deciphering the performance trends of Nakd stock, it’s essential to analyze its historical data. By examining past price movements and volume patterns, we can paint a clearer picture of how this stock has behaved in different market conditions.

One factor that plays a significant role in Nakd stock’s performance is overall market sentiment. Like many stocks, Nakd is influenced by broader economic factors and investor sentiment. When confidence is high and markets are bullish, we often see an uptick in Nakd’s price. Conversely, during times of uncertainty or bearishness, the stock tends to experience downward pressure.

Another aspect worth considering is company-specific news and developments. Any positive announcements regarding new product launches or strategic partnerships can propel Nakd’s stock price upward as investors perceive these as signs of growth potential. On the flip side, negative news such as legal disputes or earnings disappointments can have a detrimental impact on its performance.

It’s also crucial to keep tabs on industry trends that may affect Nakd’s position within its sector. A changing competitive landscape or evolving consumer preferences could influence investors’ perceptions of the company’s prospects.

In addition to these fundamental factors, technical analysis using charts and indicators can provide valuable insights into short-term trading patterns for those who prefer more quantitative approaches.

By delving into these various elements – market sentiment, company-specific news, and industry trends – we gain a better understanding of what drives Nakd stock‘s performance over time. However, predicting future outcomes remains elusive in the ever-changing world of investing! So buckle up for our next section where we explore some predictions for the future performance of this intriguing stock!

When it comes to understanding the performance of Nakd stock, several key factors come into play. These factors can have a significant impact on the price movements and overall performance of the stock.

One major factor influencing Nakd stock’s performance is market sentiment. The market sentiment refers to the general mood or attitude of investors towards a particular stock. Positive market sentiment can drive up the demand for Nakd shares, leading to an increase in its price. On the other hand, negative market sentiment can result in a decrease in demand and a decline in share prices.

Another factor that plays a role is industry trends. As an apparel company, Nakd operates within the broader retail industry sector. Any shifts or changes within this sector can affect how investors perceive and value Nakd stock. For example, if there is increased competition or disruptions within the retail industry, it could negatively impact Nakd’s performance.

Financial indicators also play their part in influencing Nakd stock’s performance. Factors such as revenue growth, profitability ratios, and debt levels are closely scrutinized by investors when making investment decisions. Strong financial fundamentals can attract investors and contribute to positive stock performance.

Furthermore, macroeconomic factors cannot be overlooked when analyzing Nakd stock’s performance trends. Economic conditions such as inflation rates, interest rates, and consumer spending patterns all have potential impacts on not only individual stocks but also entire markets.

Lastly- social media platforms like Twitter or Reddit have gained immense influence over investor behavior recently due to their ability to facilitate discussions about specific stocks like NKD among users with shared interests.

These online communities often fuel speculation about certain stocks which may lead to significant fluctuations in their prices!

Market sentiment, industry trends, financial indicators, macroeconomic factors, and even social media platforms all intertwine together shaping how NAKD performs! By keeping a close eye on these varied influences one may get better insights into Nakd stock’s performance trends and potentially make more informed investment decisions.

The Impact of Social Media and Reddit on Nakd Stock

The Impact of Social Media and Reddit on Nakd Stock

Social media platforms have become powerful tools for information dissemination, giving retail investors a platform to share their insights and opinions. One such platform that has gained significant attention in recent years is Reddit. With its vast user base and active communities, Reddit can exert influence on the stock market.

When it comes to Nakd stock, social media discussions often create waves of volatility. The company’s performance trends are closely scrutinized by Redditors who eagerly discuss potential catalysts or pitfalls that may affect the stock price.

Reddit’s WallStreetBets community, in particular, has played a crucial role in shaping the narrative around Nakd stock. This group of individual investors leverages meme culture and collective action to rally behind certain stocks, including Nakd.

These online communities generate immense buzz around specific stocks like Nakd through viral posts, memes, and coordinated buying efforts. As more people join these discussions or take action based on the sentiment expressed online, it creates a self-fulfilling prophecy where social media activity directly impacts the stock’s performance.

While social media can provide valuable insights and opportunities for retail investors, it also carries risks. Market manipulation attempts fueled by misinformation or pump-and-dump schemes can lead inexperienced traders astray.

Investors should approach these discussions with caution before making any investment decisions regarding Nakd stock. It is important to conduct thorough research beyond what is shared on social platforms and seek advice from trusted financial professionals when considering investing in volatile stocks influenced by online communities like Reddit.

In conclusion,

The impact of social media platforms like Reddit on the performance of stocks such as Nakd cannot be ignored. These platforms have created an unprecedented level of connectivity among retail investors but also come with associated risks due to volatile sentiment swings driven by online communities’ actions. Understanding this dynamic will help investors navigate this new landscape more effectively while decoding Nakd Stock’s performance trends

Predictions for the Future Performance of Nakd Stock

Predictions for the Future Performance of Nakd Stock

With the volatility and unpredictability surrounding the stock market, making accurate predictions performance of any stock is a challenging task. However, when it comes to Nakd Stock, several factors can provide us with some insight into its potential trajectory.

We must consider the company’s financial health and overall growth prospects. Is Nakd Stock generating consistent revenue? Are they expanding their product line or entering new markets? These factors can indicate whether the company has a strong foundation for future growth.

Additionally, keeping an eye on industry trends and market conditions is crucial. Is there increasing demand for products similar to those offered by Nakd Stock? Are there any regulatory changes that could impact their operations? Understanding these external influences can help assess how well-positioned Nakd Stock is about its competitors.

Another important aspect to consider is consumer sentiment towards the brand. What do customers think about Nakd’s products and services? Are they gaining traction in popular culture or facing backlash from consumers? Monitoring social media platforms and customer reviews can offer valuable insights into public perception.

Furthermore, investor sentiment plays a significant role in shaping a stock’s performance. Analyzing trends among institutional investors and monitoring insider trading activity can give us clues as to how confident others are in investing in Nakd Stock.

It’s essential to recognize that unforeseen events such as economic recessions or global crises can significantly impact any stock’s performance. While we cannot predict such events precisely, being aware of potential risks allows us to be prepared for various scenarios.

In conclusion (without using those words), predicting the future performance of any individual stock like Nakd is incredibly challenging given all these variables at play. However, by carefully analyzing financial indicators, market conditions, consumer sentiment, investor behavior, and global trends within reason; we may gain some understanding of where things might head next!

Risks and Considerations for Investing in Nakd Stock

Risks and Considerations for Investing in Nakd Stock

While the performance trends of Nakd stock may seem promising, it is important to consider the risks and potential pitfalls before diving into any investment. Here are some key factors to keep in mind:

1. Volatility: Like many stocks in the retail industry, Nakd stock can be subject to significant price fluctuations. This volatility could result from various factors such as changes in consumer sentiment, market conditions, or even company-specific events.

2. Competition: The fashion industry is highly competitive, with new brands and trends emerging constantly. As an investor, you need to assess whether Nakd has a unique selling proposition that differentiates it from its competitors and ensures long-term growth.

3. Consumer Preferences: Fashion is subjective, and consumer preferences can change rapidly. If customer tastes shift away from Nakd’s offerings or if the brand fails to adapt to evolving fashion trends, there could be negative consequences for its financial performance.

4. Supply Chain Disruptions: Any disruptions in the supply chain can have a significant impact on a company’s ability to deliver products on time and meet customer demand. External factors like natural disasters or political instability can disrupt manufacturing processes or hinder distribution networks.

5. Economic Conditions: The overall state of the economy can greatly influence consumer spending habits and impact companies operating within the retail sector like Nakd. During economic downturns or recessions, consumers may tighten their wallets, leading to decreased sales for fashion retailers.

6. Regulatory Environment: Changes in government regulations related to labor laws, trade policies, taxes, or environmental standards can significantly affect a company’s operations and profitability.

7. Social Media Influence and Reddit Effect: As we discussed earlier, Nakd stock has shown increased volatility due to social media platforms like Reddit where individual investors come together with collective buying power. This phenomenon adds another layer of unpredictability as it is challenging to accurately predict the impact of social media trends on stock prices.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.